This guide showcases how integration with Balad works

Offering a streamlined approach to connecting with our cross-border payment infrastructure.

In just one week, a single developer can go from setup to full deployment using a fast, scalable, and secure API.

No complexity. No delays. Just a smarter way to integrate.

Similar Posts

Developing Markets as Fintech Hubs: Egypt’s Role in the Future of Digital Finance

The global fintech landscape is evolving rapidly, and developing markets are emerging as powerful fintech hubs. Regions like Southeast Asia, the Middle East, and Africa are investing significantly in their fintech ecosystems, aiming to drive digital economic development. Egypt, as a key player in the Middle East and North Africa (MENA) region, is positioning itself…

The Psychology of Sending Money: Beyond Financial Needs

Imagine you’re living abroad, far from the warmth of your family in Egypt. Each month, you log into your bank’s app, navigate the secure transaction process, and send a portion of your earnings back home. While this might seem like a routine money transfer, it’s much more than just a financial transaction. It’s an emotional lifeline, a tangible way…

The Great Digital Shutdown: When Fintech Met Its Match in the Microsoft Outage

On July 18th, 2024, a seemingly innocuous configuration change within Microsoft Azure, the cloud computing giant’s platform, triggered a domino effect that sent shockwaves through the global financial system. What began as a minor glitch snowballed into a near 19-hour outage, crippling vital services for businesses and individuals worldwide, particularly in the rapidly evolving realm of…

Global Remittance Insights: How Cross-Border Payments Are Shaping the Future with Egypt at the Center

The world is more interconnected than ever, and few things make that more tangible than the flow of money across borders. Remittances aren’t just financial transactions. They’re lifelines for families, fuel for local economies, and key drivers of global development. But how are these flows evolving? And what role do fintech platforms like Balad play…

10 Habits Every Small Business Should Adopt for Continuous Improvement

In a world where competition is fierce, continuous improvement is key to the long-term success of any small business. Whether you’re a fintech innovator like Balad, facilitating cross-border payments and secure transactions, or managing a retail business, these 10 habits can help your business thrive and adapt to a rapidly evolving market. Let’s dive into…

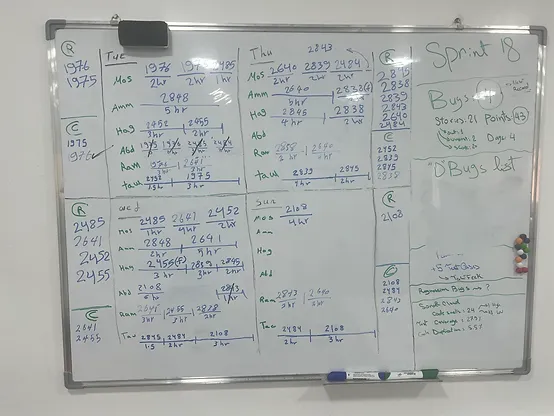

From Boundaries to Breakthroughs: The Evolution of Balad’s One-Week Sprint

Introduction: Welcome back to our series on Balad’s innovative journey through our recent one-week sprint. In our previous post, we shared the excitement and strategy behind this bold initiative. Today, we delve deeper, uncovering the array of challenges we faced and how we, as a team, transformed these hurdles into stepping stones for growth and…

Thankyou for helping out, good information.